Bullish on growth prospects, Abu-Dhabi headquartered Lulu Financial Holdings is expanding its NBFC business in India by initially focusing on organic growth and is targeting to have a loan book size of Rs 100 crore by the end of March next year, according to a top company official.

Lulu Financial Holdings, which is mainly into financial services, has investments in the Indian sub-continent, GCC (Gulf Cooperation Council) and APAC (Asia Pacific) regions. In India, the company owns the NBFC — Lulu Financial Services (India) Private Ltd — and Lulu Forex Private Ltd, India.

The NBFC (Non-Banking Financial Company) started operations last year and is in the process of expanding its business starting from the South, Lulu Financial Holdings Managing Director Adeeb Ahamed said.

“We have got into the NBFC space and it is very big in India…. It is a growth sector and we are targeting that as an area that we will be investing more… We have started expanding in Kerala and we will be taking it to other states as well,” he told PTI in a recent interview. Currently, the NBFC business is focusing on the SME (Small and Medium Enterprises) sector. “We are hoping to have a book size of Rs 100 crore by March 2023. It is the lending side,” Ahamed said

In a report released in March, rating agency Icra Ratings said the asset under management of NBFCs (retail) in India is expected to grow by 5-7 per cent in fiscal 2022 and by 8-10 per cent in fiscal 2023. According to Ahamed, initially, the company will look at organic growth for the NBFC vertical as it will provide an opportunity to be more grounded and hear out the consumers more closely.

“If it is inorganic, then it will be taking too much on the plate at this point of time. With such volatility in the market, we would rather like to grow organically. First two years of expansion will be fully organic,” he said.

About the regulatory framework in India, Ahamed said the country is a strong and growing market, and there have been a lot of changes.

“India is a very strong market but it is a growing market. One should not see it in comparison to other matured markets and start making strategies that have worked in other markets. We would always want to see India as a market of its own, which has its own character… a lot of things have changed in the last few decades,” he pointed out.

Emphasising that his group is not here for a valuation purpose but for the long-term, Ahamed said it had set up the forex division in 2012 and at that time, it did not have the interest to go to any other space.

“Today, a lot of regulations have been eased and it is more comfortable for international people like us to come. It encourages us to come and start deploying our own funds in the market,” he said. Lulu Financial Holdings has a presence in the hospitality space also but the core focus is the financial sector.

Popular NEWS

November 12, 2025

LuLu Forex Expands Presence in Bangalore with the Inauguration of its 32nd Customer Engagement Centre at Whitefield

July 23, 2025

Joining Hands with Champions: LuLu Forex & LuLuFinserv Partner with the Argentine Football Association (AFA)

October 3, 2024

LuLu Forex Celebrates 13th Anniversary with CSR Initiative: New Play Area for St. Augustine’s U.P. School

September 8, 2024

LuLu Forex Opens 31st Branch in India at LuLu Mall, Kozhikode

June 12, 2024

LuLu Forex expands its presence with three customer engagement centers in South India

October 12, 2023

LuLuFin flies high; opens 4 forex counters at Cochin International Airport

September 7, 2023

Global Fintech Awards 2023: Adeeb Ahamed wins Leading Fintech Personality of the Year Award at GFF

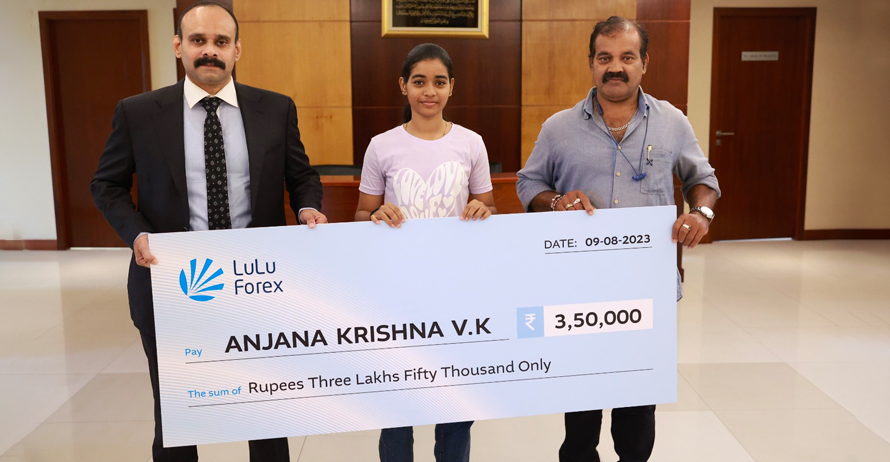

August 9, 2023

Adeeb Ahamed Empowers 17-Year-Old Girl's Dream to World Powerlifting Championship

May 31, 2023

Adeeb Ahamed of LuLu Financial Holdings appointed as Chair of FICCI Middle East Council

September 30, 2022

LuLu Forex, Jyothy Laboratories among private companies awarded for Best TDS Compliance by IT Department

LatestNEWS

Please feel free to contact us

Choose from one (or more) of the options on the right and we’ll be in touch.

For direct contact, please click here

Enquire Now

Enquire Now