When the pandemic struck, experts forecast a massive dip in global remittances. These forecasts though didn’t consider the power of human emotion in connecting the world’s 200+ million migrant communities with their families back home.

Negating all forecasts, the remittance industry saw a drop of only 1.6 per cent in 2020 and went beyond expectations to record a growth in 2021. A familial bond holds an intangible value, as the numbers prove. This year, the International Day of Family Remittances – celebrated annually on June 16 – comes at a time when the world is grappling with a heightened sense of economic insecurity.

While economies will struggle and jobs affected, the migrant worker’s role in strengthening the social contract with their loved ones has gained newfound attention. The sacrifice and hardship of the world’s migrants are a precursor to the $600 billion and more remitted every year. Over 800 million families rely on this flow to supplement their income shortages and lead a qualitative life. The role of remittances in upholding the UN’s Sustainable Development Goals cannot be discounted, although it only forms half the story of family wellbeing.

Enabling financial inclusion for families

Equitable financial inclusion remains the ultimate KPI of a society in progress. In developing economies, families at the receiving end of remitted money often have little understanding of avenues for savings and investments. Yes, the money is coming in, but it’s always risky to be dependent solely on it for sustenance.

In this regard, it’s important to empower families and create opportunities for easier access to finance, as well as to invest one’s human capital into income streams to grow their standard of life. Conjoining this other half of the spectrum with the remittance economy is thus critical to ensure a migrant’s contribution reaps good dividends at a family and community level.

Financial literacy takes top priority in this regard. The onus is on multiple stakeholders connected to the financial services ecosystem to bridge the gap so that this flow of money acts as capital or source of investment for families to take the next step in wealth creation. This will ultimately have a far-reaching impact on shaping several aspects of community development by promoting entrepreneurship and a yearning for sustainable livelihood in the society.

Programs around financial literacy aren’t new, but tying their objectives with beneficiary families is bound to have a greater scope in unlocking societal development. In an uncertain world, there cannot be a bigger contribution to advance the cause of financial inclusion, while simultaneously honoring the efforts of those remitting their hard-earned money.

Popular NEWS

November 12, 2025

LuLu Forex Expands Presence in Bangalore with the Inauguration of its 32nd Customer Engagement Centre at Whitefield

July 23, 2025

Joining Hands with Champions: LuLu Forex & LuLuFinserv Partner with the Argentine Football Association (AFA)

October 3, 2024

LuLu Forex Celebrates 13th Anniversary with CSR Initiative: New Play Area for St. Augustine’s U.P. School

September 8, 2024

LuLu Forex Opens 31st Branch in India at LuLu Mall, Kozhikode

June 12, 2024

LuLu Forex expands its presence with three customer engagement centers in South India

October 12, 2023

LuLuFin flies high; opens 4 forex counters at Cochin International Airport

September 7, 2023

Global Fintech Awards 2023: Adeeb Ahamed wins Leading Fintech Personality of the Year Award at GFF

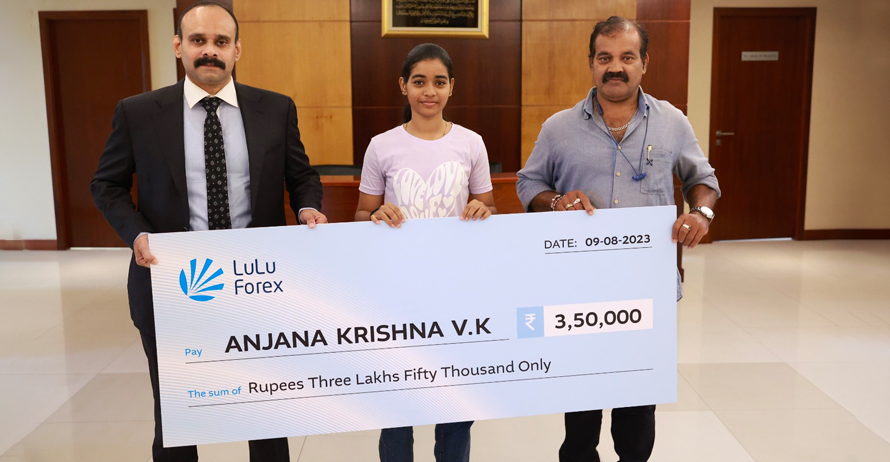

August 9, 2023

Adeeb Ahamed Empowers 17-Year-Old Girl's Dream to World Powerlifting Championship

May 31, 2023

Adeeb Ahamed of LuLu Financial Holdings appointed as Chair of FICCI Middle East Council

September 30, 2022

LuLu Forex, Jyothy Laboratories among private companies awarded for Best TDS Compliance by IT Department

LatestNEWS

Please feel free to contact us

Choose from one (or more) of the options on the right and we’ll be in touch.

For direct contact, please click here

Enquire Now

Enquire Now